This is just one example of the billions in unclaimed bonds that are waiting to be found.

This is just one example of the billions in unclaimed bonds that are waiting to be found.

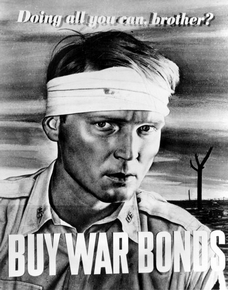

AP – This undated picture shows a war bond poster painted by Robert Sloan for the U.S. government encouraging people to buy war bonds.

By MATT GOURAS, Associated Press Writer Matt Gouras, Associated Press Writer – Sun Oct 18, 4:56 pm ET

HELENA, Mont. – The federal government is facing a lawsuit over billions in unclaimed bonds that date back to the patriotic fundraising efforts of World War II, leading to a showdown between states who say they should be given the money and a Treasury Department that claims ownership.

World War II sparked an unprecedented bond buying campaign, spurred on by one of the largest advertising campaigns ever seen — a drive wrapped in dutiful pleas from celebrities, politicians and cartoon characters alike.

Most American families bought at least one bond at the time and many never cashed them in — thanks in part to a 40-year maturity in the bonds. And those same “Series E” war bonds continued to be sold by the federal government until 1980.

More than $16 billion worth of the bonds are unclaimed, either lost or forgotten about with the death of the original purchasers.

The state attorneys general suing the Treasury Department charge that the federal government made no effort to find those people. They want the money given to the states, who have a legal system in place for finding the owners of unclaimed funds, including unclaimed bonds.

“It’s better for the millions of American who are the rightful owners to have it returned to the states, because the states will make a real effort to find them,” said David Bishop, a partner at Kirby McInerney who is representing the states in the suit. “And if after searching for them they can’t find them, the money can go to work in the communities where the bonds were purchased.”

The Treasury Department counters that it indeed tries to find owners of the unclaimed bonds, and says it has a Web site where people cam simply type in their Social Security number to see if they have one. And it points out that the money is not just laying around somewhere.

“One of the misunderstandings out there is that there is a lot of cash sitting somewhere in a drawer. Money from savings bonds was used to run the daily operating expenses of the government,” said Joyce Harris, with the Bureau of the Public Debt. “These are obligations of the federal government, not the states. There is no pot of gold out there just waiting for someone to grab it.”

The Treasury also points out that most of the unclaimed bonds are far more recent than the original World War II era bonds. And overall, 99 percent of people claim their bonds.

“Quite frankly, people are aware of the bonds,” she said. “A majority, when you contact them, are aware of the bonds.”

It’s not like the states will get the money free of obligation, about $55 million in the case of Montana. The states would be obligated to pay bondholders no matter if it takes them decades — or longer — to show up. In the meantime, though, states usually earmark the interest earned on such unclaimed money for schools or other purposes.

Steve Bullock, the attorney general for Montana, said states — not the federal government — have legally been granted the right to deal with unclaimed money.

“First and foremost I think it is the right thing to do. I think it is money that should be with Montanans,” Bullock said. “It’s an important action to bring just to protect the state’s interest.

The complaint was first filed in Federal court in New Jersey in 2004 with New Jersey and North Carolina as the plaintiffs. Montana, Kentucky, Oklahoma and Missouri later joined the case. All states would benefit if the lawsuit is successful.

The case will come down to constitutional arguments. Attorneys for the federal government are arguing the states don’t have standing on what they see as a contract issue between the original purchasers and the Treasury Department.

The states expect arguments in the case to be made later this year on a motion from the federal government to dismiss the case.

How do you know there real ww2 bonds I have my grandpas

I need my dads war bonds how do I get them sent to me rita smith

War bonds unclaimef

Hey Mike,

I have went on this link to try to find my husband’s war bond that his father left him but it has been taken down is there any other places I could look to try to find it?

http://www.treasurydirect.gov/indiv/tools/tools_treasuryhunt.htm

My grand father decedent in 1974 leavening me ww2 savingbonds I would like to have them

MY SON S FATHER WAS TO HAVE LEFT HIM PICTURES AND ENOUGH MONEY TO TAKE OF MY SON AN MYSELF, left in a box hidden. But no money was in the box. He also told his oldest grandson where it was . Pictures were in the box marked RANDY But no money, How do I go about getting what is my sons for him,

My father is still living. however his war bonds are somewhere in the house or misplaced elsewhere. where do we go from here.???

Were these bonds issued during the Korean war?

Yes, this article mentions bonds being held since WW2 but there are also bonds from Korea and Vietnam. I think there are 700,000 unclaimed bonds in total.

Thanks Mark, that was really interesting. Also thanks again for helping average people to acheive the American Dream.

Earl L Shawhan Jr http://assetrecoveryconsultant.com

Got a notice saying that some one found war bonds in my name just hopen

How were you related to Mel Mawrence?

Mel Mawrence was my Uncle. Who are you using his name?

My father was in world war 1&2 Col Melvin MAWRENCE looking for bonds

Was Mel Mawrence your father?

JOHN R. DIAL SR

RAYMOND W. DIAL

LEFT UNCLAIMED U.S. BONDS

Hope,

You can start here, http://www.treasurydirect.gov/indiv/tools/tools_treasuryhunt.htm , but it will help to have your grandparents social security numbers.

Good luck!

Hi. My name is Hope Innes. I remember my grandmother having old war bonds in her loft before the fire that wiped out everything. They were from Pike County Bank in Troy, AL which is now Troy Bank & Trust. I was wondering if these may still have value if I can prove who my grandfather and grandmother were. If they are, please let me know how I would go about claiming these and getting a hold of the necessary people to do this.

“says it has a Web site where people cam simply type in their Social Security number to see if they have one”

Would have been a good idea to include a Link here folks .

Ty

Mike,

Thanks for pointing that out. I have added the link to the page that gives more information on that.

The link to enter your social security number is at the bottom of that page where it says “start search”, but if you want to skip all of that information you can just click https://www.treasurydirect.gov/TH/BPDLogin?application=thpublic&page=thpublic and get started.

You can also go to http://www.treasurydirect.gov/NC/FoRMSHome?FormType=SBF&site=indiv to download forms on just about everything related to bonds, lost bonds, stolen bonds, etc.